Table of Contents

Ensuring a smooth and secure payment experience is an important part of optimizing your eCommerce store for a better customer experience.

Adding the right payment gateway can help you achieve it with ease. If you are unsure of how to do it, the article will help you to learn everything there is to know about payment gateways.

What is a Payment Gateway?

To understand the article in its entirety, you should have a clear idea regarding what payment gateways are.

A payment gateway is a merchant service provided by an e-commerce application service provider to process payments for online purchases on a merchant website. Simply put, it allows your customers to enter their payment information securely and make payment for their purchases in your eCommerce store.

How Does a Payment Gateway Work?

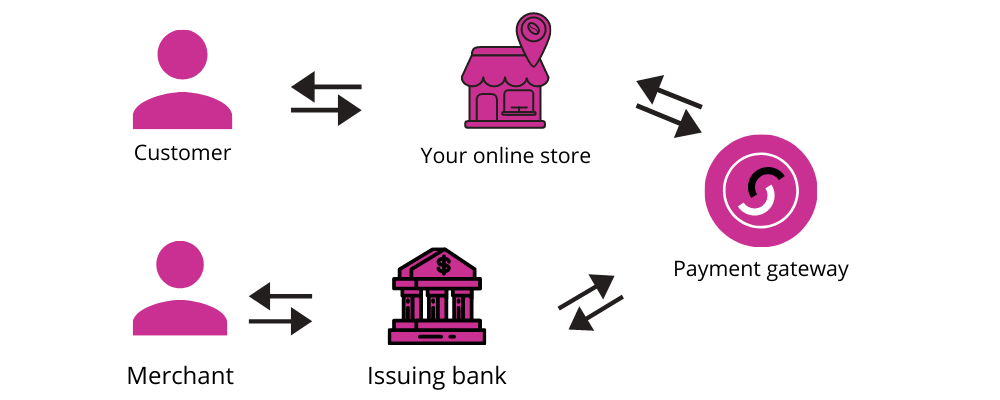

The following section will walk you through the typical journey a payment gateway goes through to process a payment made by a customer.

Step 1 – Once a customer visits your WooCommerce store and finds the right product they were looking for, they will go to the checkout page and choose a payment gateway of their choice (most eCommerce platforms offer multiple payment gateways for the convenience of their customers.).

Step 2 – Now, the customer has to fill in the payment gateway page with the essential information regarding the bank or the card they are using to make payments. Then the user will be directed to the page of the issuing bank or a 3D secure page, asking for the transaction to be authorized.

Step 3 – When the payment gateway gets approval for the transaction from the customers’ issuing bank, it checks whether the customer has sufficient balance in the account to make this transaction successful or not.

Step 4 – Based on the reply received from the bank, the payment gateway sends a message to the merchant. If it’s a “No” the merchant sends an error message to the customer explaining the issue with the card or the bank account and if it’s a “Yes” the merchant can seek a transaction from the bank.

There are a number of options for payment gateways for you to choose from. But which one you choose for your business can make a lot of difference. There are a number of things that you need to consider for choosing the right payment gateway. Thus take a better look at what they are.

Things to Consider When Choosing a Payment Gateway for your WooCommerce Store

Choosing the right payment gateway is essential for the smooth functioning of your business. Here are the most important factors that you need to consider while choosing a payment gateway for your WooCommerce store.

Classic or Modern Payment Gateway?

Payment gateways come in two categories – classic and modern. Choosing between these two will be the first step to finding the right payment gateway for your store. The major difference between the two are – classic payment gateways require you to have a merchant account for the transactions to occur whereas modern payment gateways don’t require one.

Most of the payment gateways supported by WooCommerce are classic ones although there are a few modern ones too. To make the best choice you need to know more about their differences.

Classic payment gateways

Other than needing a merchant account, Classic payment gateways come with a lower transaction fee but a longer set up process. Since it requires you to integrate via API, you need to have a minimal level of technical knowledge as well. The best examples for classic payment gateways are; Authorize.net and WorldPay.

Modern payment gateways

Unlike classic payment gateways, modern payment gateways are easy to set up as they don’t need a merchant account. But on the downside, it charges a higher per-transaction fee compared to classic payment gateways and sends customers off-site to make a payment, which could adversely affect the conversion rate of your WooCommerce store. Popular examples for modern payment gateways are PayPal and Stripe.

Cost

The cost involved in using a payment gateway can be different for different payment gateways. Thus when you make a choice you need to evaluate the pricing structure of each of these payment gateways.

The total cost incurred by a payment gateway is the sum of three types of fee – set up fee, monthly fee, and transaction fee. You need to consider both the volume and value of your transactions to find the most cost-effective choice of payment gateway for your business.

A transaction fee of 1% is not that high for most businesses, but when the value of transaction increases or if you are selling luxury goods you should go for a payment gateway offering their services at a fixed monthly fee and a low transaction fee.

Location

If you are selling to customers across the globe, you need a payment gateway like WooCommerce Paddle Payment that supports securable international transactions. Many payment gateways only support certain countries and currencies which leaves you with no option if you wish to trade in a country not supported by your payment gateway.

Since most people like to purchase in their native currency you need to select a service that not only works for the residing country of your customers but that also accepts the relevant currencies. While making transactions with foreign countries you need to take a note of the fee charged by your payment gateway provider as they often vary from country to country.

Security

Security is of the utmost importance when it comes to online transactions as it involves dealing with sensitive financial information of both the merchant and customers. Thus you should go for payment gateways that ensure strict security measures to protect your data.

Different payment gateways comply with different security standards. So keep in mind to always go for a payment gateway that is level-1 PCI DSS compliant with VeriSign SSL certificates and CVV2 verification.

In addition to choosing a secure payment gateway, you also need to ensure the security of your WooCommerce store. Most payment gateways require your website to have an SSL certificate. It is also a best practice to make sure your website is covered by the Payment Card Industry Data Security Standard (PCI-DSS).

Support for subscriptions

If your WooCommerce store sells subscription products, which you can enable by you need to go for a payment gateway that supports subscriptions.

Payment options

The availability of different payment options holds great importance if you have a large number of customers or clients. There is a higher chance for cart abandonment if you fail to provide your customers with adequate payment options.

Thus make it a point to check if your payment gateway accepts all major credit cards and debit cards in it. You should also consider if the payment gateway accepts credit cards that are local to the area you are doing business in and that it supports Apple pay, Android pay, etc.

Now that you have understood all the factors that go into choosing the right payment gateway, let us explore what are the options that you have.

Stripe

Stripe is a US-based payment gateway platform founded by Patrick Collison and John Collison in 2009. It currently powers millions of businesses in 100+ countries that belong to varied industries. Over the years Stripe has become the best tool that aid in the fast-growing of many businesses across the globe.

Being a developer-friendly tool, it eliminates all the unnecessary complexities and allows you to set up Stripe in just a couple of minutes. It’s a complete payment system that allows you to bill customers on a recurring basis, set up a marketplace, or simply accept payments.

To avoid fraud and disputes, Stripe offers you features such as Stripe radar, dynamic 3D secure, and end-to-end automated process (that submit evidence based on the type of dispute and associated network rules).

The intuitive Stripe dashboard or API allows you to easily get paid once a transaction has settled. It supports both unified and multi-currency payouts and lets you manage historical and upcoming deposits, and monitor expected payout dates right from the dashboard.

Stripe is loved and used by popular platforms such as Shopify, Salesforce, Squarespace, Booking.com, Open table, Target, Unicef, HubSpot, and more.

PayPal

PayPal is another US-based payment platform founded in 1998. It lets your small and medium-sized businesses to thrive using with its simple set up and easy to use tools.

Paypal allows you to accept payments in many different ways including online, in person, by phone, or email which is a very desirable quality for an online payment platform. For the online payment, your customers can make use of credit cards, debit cards, alternative payment methods3, PayPal, and PayPal Credit.

In-person payment can be accepted in-store or on the go with a card reader and your smartphone or tablet. Customers can pay how they like – by credit card, debit card, or contactless, including Apple Pay. You can also take payments via phone or make use of the customizable invoicing to provide estimates, send invoices, and let your customers pay via email.

Seller protection and fraud protection built-into this platform ensure all-around security of both your customers and your store. Programs such as Funds now and instant transfer that give eligible businesses quick access to money, simple and speedy resolution of disputes, built-in reporting, and analytics, etc, are additional features offered by this payment gateway platform.

Square

Square was founded by Jack Dorsey and Jim McKelvey in 2009, the same year as Stripe was founded. This payment platform was developed to provide you with a secure and reliable solution that accepts all your customers’ payments along with addressing their unique needs.

It is capable of processing millions of payments on a daily basis in a highly secure environment. With end-to-end encryption, it ensures that your customer’s payment data never touches your servers or devices. Square also runs a security check every day, 24/7 to eliminate any potential vulnerabilities.

Running an online business requires you to adhere to certain security standards, and Square makes it easy for you interestingly at no extra cost. PCI compliance, AML, and KYC checks can be easily done with this payment platform.

With Square’s customer API, catalog API, and inventory API you can make informed decisions with a complete view of your business across all of your online and in-person sales. Square APIs also allow you to transfer transaction data into a CRM, OMS, ERP, or any enterprise business solution.

Finally, if you are concerned about how much would it cost you to enjoy their awesome service, no worries. Square doesn’t come with fixed charges rather they let their customers choose how much they want to pay with custom pricing.

Authorize.net

Authorize.net founded in 1996 and was later acquired by CyberSource (Visa). It comes with a wide array of features including advanced fraud protection, customer information manager, variety of payment types, recurring payments, account updater, invoicing, and more.

Authorize.Net allows you to accept cards both on the web and through mobile devices. Billing is made way too easy with this payment gateway as it allows you to process recurring subscription payments, allows you to customize pricing, offer free trials and installment packages, etc.

Its Advanced Fraud Detection Suite (AFDS) has 13 filters that you can configure to your needs so you can detect and block potentially fraudulent transactions. This security feature comes entirely free with your account.

Customer Information Manager or CMI is the most powerful feature of this online payment platform. With the help of this feature, you will be able to securely store customer information such as billing address, shipping address, and payment method information.

Should you encounter any problems while using this platform, help is available in all formats. 24/7 phone support, ticketing system, online resources (articles, knowledgebase, video tutorials, etc.), even social media can be used for fixing your issues related to this solution.

Conclusion

Providing your customers/clients with a flexible, secure, and quick payment experience is highly important to ensure the smooth flow of your business. With the rising number of credit card and other financial frauds, showing and making your customers believe that you are trustworthy goes a long way in turning your business into a success.

Check out this article to find out the best payment plugins for WooCommerce.